A Michigan Man Underpaid His Property Taxes By $8.41. The County Seized His Property, Sold It—and Kept the Profits.

A state law allows counties to effectively steal homes over unpaid taxes and keep the excess revenue for their own budgets.

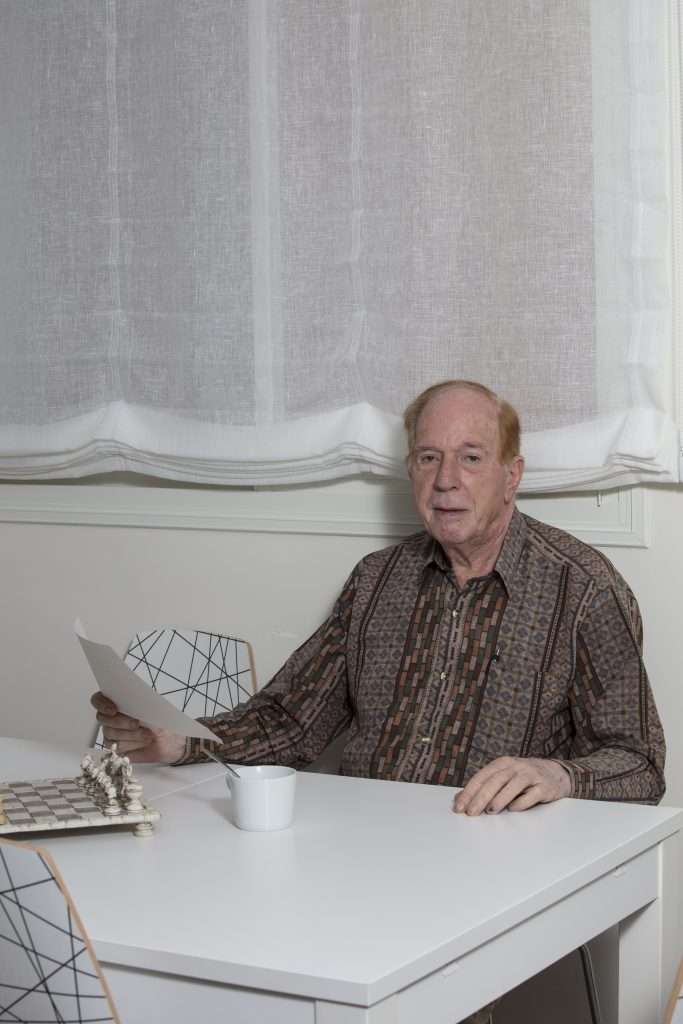

(Robin Nelson/ZUMA Press/Newscom)

An 83-year-old retired engineer in Michigan underpaid his property taxes by $8.41. In response, Oakland County seized his property, auctioned it off to settle the debt, and pocketed nearly $24,500 in excess revenue from the sale.

Under Michigan law, it was all legal. And hardly uncommon.

Uri Rafaeli, who lost his property and all the equity associated with it, is just one of thousands of people to be victimized by Michigan's uniquely aggressive property tax statute. The law, passed in 1999 in an attempt to accelerate the rehabilitation of abandoned properties, empowers county treasurers to act as debt collectors. In the process, it creates a perverse incentive by allowing treasurers' offices to retain excess revenue raised by seizing and selling properties with delinquent taxes—even when the amount owed is miniscule, and even when the homes aren't abandoned or blighted at all.

Organizations representing property owners like Rafaeli say the practice is unconstitutional, inequitable, and unreasonably harsh. They call it "home equity theft"—a process that's a close relative to the civil asset forfeiture laws that have been used by police departments to similarly deprive innocent Americans of their property without due process. They are now asking the state Supreme Court to restrict the practice.

"Michigan is currently stealing from people across the state," says Christina Martin, an attorney with the Pacific Legal Foundation, a nonprofit law firm now representing Rafaeli and other homeowners in a class-action lawsuit that will go before the Michigan Supreme Court in early November.

"Counties have been authorized to take not just what they are owed, but to take people's life savings."

A Win-Win Situation

Rafaeli's case—which has the potential to stop the predatory behavior of county treasurers across the state—began with a simple mistake.

In August 2011, Rafaeli purchased a three-bedroom, 1,500-square-foot home in the predominantly African American community of Southfield, Michigan, a lower-middle-class suburb just north of Detroit. "The investment was good to the state economy, and [at] the same time, it may produce a good rent for my retirement. A 'win-win' situation," says Rafaeli, who lived in neighboring Macomb County at the time. (He no longer lives in Michigan.)

The $60,000 purchase was recorded by the Oakland County Register of Deeds on January 6, 2012. About six months later, in June 2012, Rafaeli was notified that he had underpaid his 2011 property tax bill by $496. Rafaeli made subsequent property tax payments on time and in full—and, in January 2013, he attempted to settle the unpaid tax debt, according to court documents.

But he made a mistake in calculating the interest owed, resulting in another underpayment of $8.41.

A little more than a year later, in February 2014, Rafaeli's rental property was one of 11,000 properties put up for auction by Oakland County. It was sold for $24,500 in August of the same year—far less than what Rafaeli had paid for the property just three years earlier.

Today, real estate service Zillow, which rates the Southfield region as a "hot" market in the Detroit region, estimates the property is worth $128,000, But Rafaeli has missed out on reaping a financial reward for being an early investor in the area.

"I believed in the power of the U.S. to withstand the difficulties," says Rafaeli, "and I believed in its fairness and dignity in doing business there." Now, he says, he thinks differently.

No comments:

Post a Comment