ObamaCare & The Hyper-Inflation Of Healthcare Costs

Authored by Lance Roberts via RealInvestmentAdvice.com,

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation.

The chart below tells you almost everything you need to know, but in this blog, we will revisit why the Affordable Care Act failed to make healthcare affordable and some solutions to fix the problem.

When it was conceived, the Affordable Care Act (ACA) was hoped to improve healthcare access. At the time, roughly 20 million Americans were uninsured. The bill hoped to lower the rising cost of healthcare in the economy by providing a Government mandate.

However, as is always the case when “Big Government” steps in, the outcomes are generally worse, not better. Such should not be surprising. At a press conference on August 12th, 1986, US President Ronald Reagan said, “The nine most terrifying words in the English language are ‘I’m from the government and I’m here to help.’”

A decade after the launch of the Affordable Care Act, we can not look back at the results. In 2023, roughly 25 million Americans still lack healthcare coverage. The government continues expanding programs, like Medicaid, to insure more individuals at a hefty cost to taxpayers. While the uninsured population has fallen by 3 million since 2014, the question is whether the costs justify the results.

Unsurprisingly, as we discussed initially, the Affordable Care Act led to a hefty increase in healthcare costs. Although its goals were noble, several key provisions - including pre-existing conditions, reduced consumer choice, and government subsidies - strained the system financially.These problems, compounded with other structural challenges, are further exacerbated by the COVID-19 pandemic, leaving insurers, taxpayers, and patients grappling with rising premiums and expenses.

We will examine these issues.

The Many Problems Of The Affordable Care Act

Pre-Existing Conditions and Insurance Pools: Spreading the Risk Unevenly

One of the ACA’s most controversial provisions required insurance companies to cover individuals with pre-existing conditions without charging higher premiums. This ensured vulnerable individuals could access necessary care and altered the insurance risk pool. Before the ACA, insurers could price premiums based on the health profile of the insured population. Using data from the healthy pool, costs could be effectively calculated, keeping prices down. However, with the inclusion of high-risk individuals who immediately started drawing from the pool, insurers faced higher costs, which had to be passed on to everyone through increased premiums.

From 2013 to 2017, individual premiums more than doubled in some areas, driven by the need to balance the new risk. Younger, healthier individuals who previously benefited from lower premiums saw the steepest increases, making it less attractive for them to maintain coverage.

Reduced Consumer Choice: Fewer Plans, Less Competition

The ACA aimed to ensure standardized health plans, but this inadvertently led to reduced consumer choice. Insurance providers were required to offer a certain set of essential benefits. While the intention was good, the demands forced many insurers to exit markets where compliance became too costly. In some states, consumers were left with only one or two insurance carriers on the exchanges.

The resulting lack of competition gave insurers more leverage to raise prices without fear of losing market share. Premiums continued to climb as consumers had few options and no bargaining power, forcing many to accept higher deductibles for basic coverage.

The Cost of Subsidies and the Burden on Taxpayers

The ACA introduced subsidies that reduced the price of premiums for those who qualified, making coverage affordable for lower-income individuals. These subsidies, however, came with a steep price tag for taxpayers. The federal government currently subsidizes ACA plans with over $50 billion annually. Additionally, expanded subsidies after the pandemic increased the federal budget burden, locking higher costs even as inflation strained public resources.

While subsidies provide short-term relief for individuals, they distort the healthcare market. Providers are less pressured to lower premiums when the patients are shielded from the underlying costs. This dynamic creates a feedback loop that drives prices higher over time, especially as insurers set premiums in anticipation of ongoing subsidy support.

Failed State Exchanges and Their Impact

The early rollout of the ACA included state-run insurance exchanges intended to offer consumers access to competitive plans. However, several states—such as Oregon and Hawaii—saw their exchanges collapse due to technical issues, poor enrollment, and mismanagement. When these exchanges failed, the federal government absorbed the costs, passing the financial burden on to taxpayers. Billions were wasted on these failed systems, while insurers withdrew from the exchanges due to instability, further reducing competition.

These failed exchanges added to federal costs and undermined the ACA’s objective of creating sustainable marketplaces. Fewer participating insurers meant even higher consumer premiums, as the limited competition eroded the benefits of market-based pricing.

The COVID-19 pandemic placed unprecedented pressure on the healthcare system, compounding the ACA’s existing challenges. Hospitals and providers experienced soaring operational costs due to increased demand, labor shortages, and supply chain disruptions. Insurers responded by raising premiums to account for higher claims and uncertainty. These price hikes hit already stretched consumers, with many households facing insurance costs that outpaced wage growth.

The government’s response to the pandemic—extending ACA subsidies and relaxing enrollment deadlines—further strained the system. While these measures helped many individuals access coverage during the crisis, they also deepened the financial burden on taxpayers.

A Cost We Can’t Afford

The design of the Affordable Care Act was deeply flawed at the outset, and as we noted in 2013, such would lead to an obvious outcome. To wit:

“It is when the full impact of the Affordable Care Act lands on those working class individuals that sentiment will turn deeply negative towards the government as higher costs, and taxes, not only impact their individual standards of living but continues to erode the economic growth in the U.S.”

Unsurprisingly, the very negative sentiment and division in the country today over the quality and costs of healthcare have come home to roost. Of course, this additional “welfare program” that is part of the mandatory spending side of the budget equation has also come to fruition.

“The current pace of increase in the participation of social welfare programs, from food stamps and disability claims to social security and Medicare, is creating an ever-increasing consumption of current revenues. Implementing another social welfare program will only create an additional drag on the revenue/expense equation.” – 2013

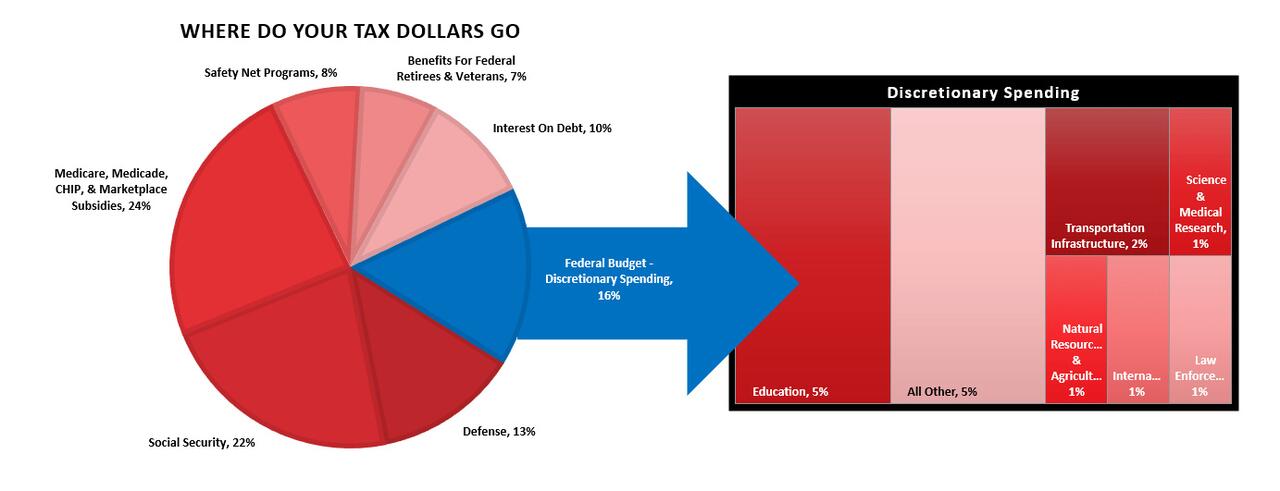

According to the Center On Budget & Policy Priorities, in 2023, roughly 90% of every tax dollar went to non-productive spending.

“In fiscal year 2023, the federal government spent $6.1 trillion, amounting to 22.7 percent of the nation’s gross domestic product (GDP). About nine-tenths of the total went toward federal programs; the remainder went toward interest payments on the federal debt. Of that $6.1 trillion, only $4.4 trillion was financed by federal revenues. The remaining amount was financed by borrowing.”

Notice that 24% of spending goes to Medicare, Medicaid, CHIP, and Marketplace Subsidies. That will only get worse over time. However, here is the issue. In 2023, 90% of all expenditures went to social welfare, non-productive spending, and interest on the debt. Those payments required $6.1 trillion, roughly 138% more than the tax dollars collected.

Those concerned about debt and deficit should question the continued support for the Affordable Care Act.

There are options.

Options For Lowering Healthcare Costs

Given the ongoing surge in healthcare costs, policymakers must reassess whether the ACA can achieve sustainable, affordable care in its current form. One option is to unwind or significantly revise key ACA provisions. For example, creating separate risk pools for individuals with pre-existing conditions could allow insurers to offer lower premiums to healthier individuals while ensuring coverage for those needing it most.

Another approach would involve deregulating the healthcare market to foster more competition. Allowing insurers to sell plans across state lines could increase consumer options and reduce premiums. Additionally, reforming subsidies by linking them to healthcare outcomes rather than premium levels could help contain costs at the source.

Revisiting antitrust enforcement in healthcare markets is also crucial. Mergers between hospital systems and insurers have reduced competition, driving prices higher. Strengthening competition policies would encourage providers to lower costs, benefiting consumers in the long run.

The ACA brought essential reforms but failed to control costs, burdening many households and taxpayers with unsustainable healthcare expenses. Revisiting the structure of insurance pools, increasing market competition, and reforming subsidies offer a way to address the root causes of rising costs. While unwinding parts of the ACA may be politically challenging, it could be a necessary step to build a healthcare system that delivers both access and affordability.

No comments:

Post a Comment